It’s the eleventh hour, and you’re racking your brain looking for deductions on last year’s taxes – don’t overlook a thing.Your vehicle just might have some deductions in store. Let’s take a look at vehicle-related tax deductions to see if you might have any items that apply.

If you’ve used your own vehicle for business, medical, moving or charity-related travel, those expenses are deductible. You can do that via a standard mileage rate or by deducting the actual cost of the vehicle.

Other eligible vehicle deductions include ones for donating your car, or for the sales tax you’d paid on a new vehicle. Read on for some basic tax information, as it relates to your vehicle – Standard Mileage Rates

The IRS issues a standard mileage rate each year for car, van or pickup trucks. Here are the IRS’ 2014 standard mileage rates:

- 56 cents per mile for business miles driven

- 23.5 cents per mile driven for medical or moving purposes

- 14 cents per mile driven in service of charitable organizations

For next tax year, here are the IRS’ 2015 standard mileage rates:

- 57.5 cents per mile for business miles driven, up from 56 cents in 2014

- 23 cents per mile driven for medical or moving purposes, down half a cent from 2014

- 14 cents per mile driven in service of charitable organizations

If you choose the standard mileage deduction, you’ll need to keep accurate records of the dates and purpose of your travel as well as your beginning and ending odometer reading. Stay ahead of Uncle Sam by keeping your log regularly. Use a free app, like MileIQ, in order to track tax-deductible mileage.

Actual Cost of the Vehicle

New cars lose their value quickly! We love this infographic from Edmunds that explains vehicle depreciation by year. That, along with a host of other vehicle expenses, is tax-deductible if you choose not to go with the standard mileage deduction.

If you often drive your vehicle often for business or medical expenses, and if the cost of operating and maintaining your vehicle is quite high, it may be more advantageous to deduct the actual cost of operating the vehicle. Here are vehicle costs that apply for deductions, courtesy of TurboTax:

- Fuel and oil

- Vehicle Maintenance, such as oil changes, new brakes and battery replacement

- Tires: tire rotation and new tires

- Registration fees and taxes

- Licenses

- Vehicle loan interest

- Insurance

- Rental or lease payments

- Depreciation, as long as you own (not lease) the vehicle

- Garage rent

- Tolls and parking fees

As with every deduction you claim, you’ll need to carefully track the costs associated with your vehicle.

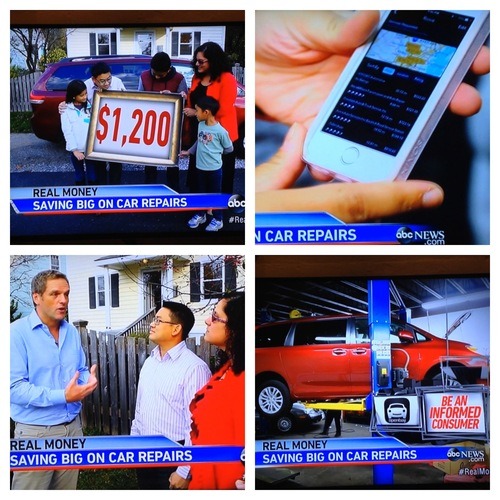

All your vehicle maintenance and repair costs can be tracked via Openbay to help you save money on those costs. Openbay, as featured on ABC World News Tonight, will gather competitive vehicle repair and maintenance quotes for you to choose from, then you pick a shop, book and pay via the app once the service is complete. Down the line, keeping track of your repair and maintenance could also help you to sell your used car.

Driving a Company Car

Do you drive a company car and also use it in your personal time? You’ll want to check with your employer whether the non-business use is considered a benefit, in which case that portion of vehicle expense could be viewed as taxable income.

Did You Buy a New Car?

The state and local sales tax you’d paid on your new vehicle – car, truck or motorcycle – purchase is deductible, and, according to Kiplinger’s, among the most overlooked tax deductions.

Donating Your Car

This isn’t an item you’d likely forget to mention while doing your taxes, as it’s such a major transaction, but maybe you should consider this next year. Weighing the options? This blog explains why you might donate a vehicle to charity, or to an educational or religious institution.

If you donate your vehicle to a 501©(3) organization, the IRS will give you a deduction on the “fair-market value” of the car. Worth noting – that may not align with its “Blue-Book” value on KBB.com, where most folks go when they’re asking, “What’s My Car Worth?”

What percentage deduction could you get off your vehicle’s fair market value? That depends on your tax bracket – here are the 2014 tax brackets and here are the 2015 tax brackets.

Advice for Next Tax Year

Regardless of how you fare this year, head into next tax year armed with the most information on tax deductions for vehicles. Know that the more information you track, the better shape you’ll be in as you file your taxes.

Work with a pro – even the likes of TurboTax and H&R Block have tons of resources at their fingertips, so should help answer any tax-related questions.

Looking to conserve money on vehicle operating costs, regardless of the tax deduction? Following your regularly scheduled maintenance will minimize the need for major preventable car repairs.

Need to schedule maintenance service? Start with Openbay. Openbay is a web and mobile app that allows customers to compare and book car repair from quality shops in their neighborhoods. From recommending local repair shops, to secure payment processing and tracking of services online; Openbay gets drivers back on the road with peace of mind.

Save upwards of 25% on

car repair and maintenance services with Openbay+